日記

準確定申告

会社辞めたから申告を自分でしないといけない二色人です

Since I left my job I have to file final an annual income tax return by myself.

会社に在籍していれば年末調整してくれるから確定申告しなくていいんだけど、辞めてしまったから源泉徴収票発行してもらって準確定申告しに行こうと税務署に電話してみた

※準確定申告は確定申告の時期以外で確定申告をすることらしい

※準確定申告は確定申告の時期以外で確定申告をすることらしい

If I kept belonging my job, a acounting would handle year-end tax adjustments, but I have already left my job, so I got a witholding tax statement and I called a tax office to confirm how to file a quasi-final return.

A quasi-final return is filing an annual income tax return except for term of final tax return.

A quasi-final return is filing an annual income tax return except for term of final tax return.

そしたら、還付金(所得税の払い過ぎによる返還されるお金)の関係で納税管理人ってのを立てた方がいいって言われた

詳しくは知らんけど準確定申告をした後に還付金が発生した場合日本に居住(住民票登録)している人じゃないと受け取れないみたい

詳しくは知らんけど準確定申告をした後に還付金が発生した場合日本に居住(住民票登録)している人じゃないと受け取れないみたい

Then, a staff taught me it had better to appoint someone a tax agent for tax refund, the tax refund is an amount of money that the government reimburses taxpayers who pay more than they owe in taxes.

I don’t know well, if I filed the quasi-final return and I got the tax refund, I wouldn’t receive it after filing moving-out notification, I heard, so it needs to appoint someone the tax agent.

I don’t know well, if I filed the quasi-final return and I got the tax refund, I wouldn’t receive it after filing moving-out notification, I heard, so it needs to appoint someone the tax agent.

住民票抜いて海外にいくから還付金受け取れないんすよね

I can’t get the tax refund, because I’m going to go abroad after filing moving-out notification.

前に市役所行ったときも相談して、納税管理人の用紙ももらってた事を思い出した

※納税管理人は自分の代理人を立てて代わりに納税の作業をするって制度みたい

※納税管理人は自分の代理人を立てて代わりに納税の作業をするって制度みたい

I went to city hall for advice before, I remembered I got a notification form of appointment of tax agent at that time.

Tax agent is a person authorized by the taxpayer to conduct acticities pertaining to the fulfilment of tax liabilities in accordanc with tax regulation in his name and for his account.

Tax agent is a person authorized by the taxpayer to conduct acticities pertaining to the fulfilment of tax liabilities in accordanc with tax regulation in his name and for his account.

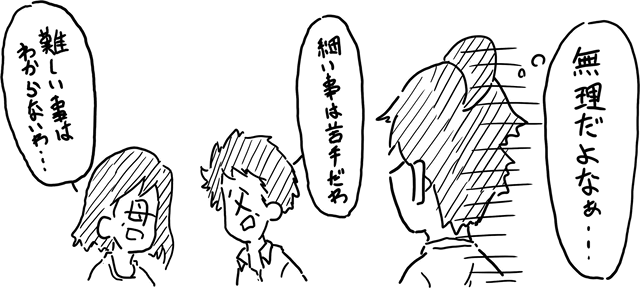

ただ、代理人の候補がウチの母と父なので諸々と不安が拭いきれず、自分の中ではありえない案だった

My mother and father were my candidate of a tax agent, but I couldn’t get rid of my anxiety, so that choice was noway in my mind.

でも、納税管理人を立てたら準確定申告せずに、確定申告をその代理人ができるようにもなるみたい

But, if I appointed someone the tax agent, I wouldn’t need a quasi-final return, because tax agent can file my final tax return instead of me.

まぁ、両親に任せると面倒くさいことになりかねないから後で確定申告遡ってすることにした

Anyway, it will probably be troublesome to leave it to my parents, so I decided to file final tax return myself later .

5年分遡って確定申告できるみたい、しかも還付金もちゃんと戻ってくるみたい

Because, I heard it is possible to file final tax return going back to 5 years worth, plus it can get the tax refund.

じゃあそれでいいやってことで住民票抜く前に申告するの辞めた

So, I quit doing the quasi-final return before filing moving-out notification.

会社辞めてみると結構面倒くさいことが多いい

自分がどんだけなにも知らずに生きてきたかを思い知らされるわ

自分がどんだけなにも知らずに生きてきたかを思い知らされるわ

I realized there were a lot of troublesome for me, when I left my job, and then it made me realize that I was really ignorance.